Partial year depreciation calculator

When you get to the depreciation section click Add to create a new asset. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000.

Depreciation Accounting Sum Of Years Digits Method With Partial Period Allocation Youtube

Straight line declining balance or sum of the years digits method.

. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Determine the cost of the asset. When you get to the depreciation section click Add Schedule E Pg 1 to.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. After a few years the vehicle is not what it used to be in the. Enter the rental income and expenses for the portion of the tax year the home was used as a rental property.

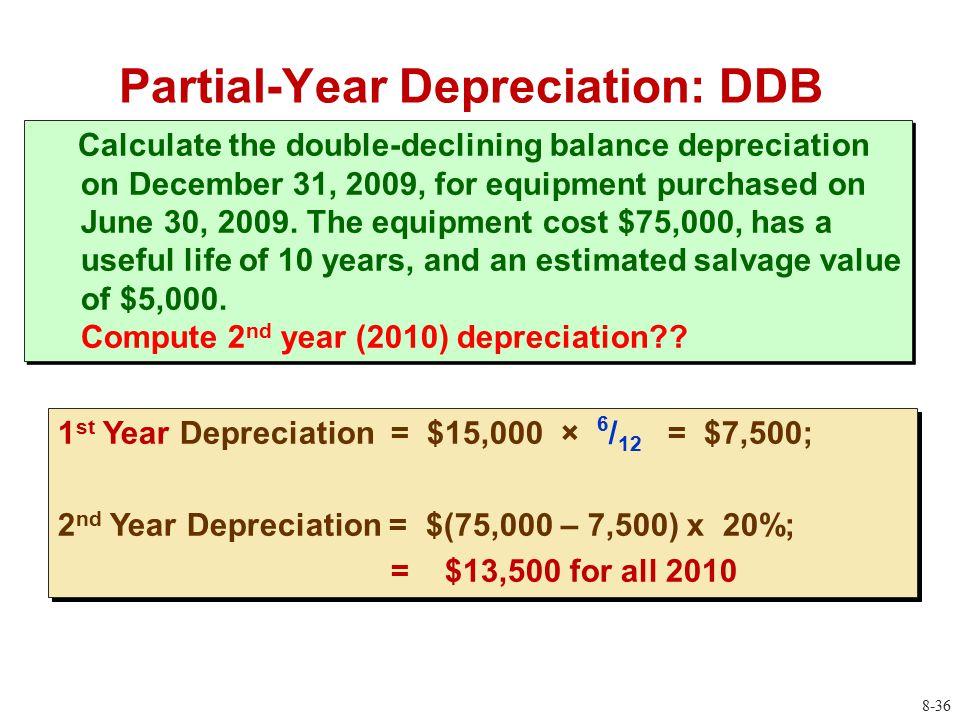

This limit is reduced by the amount by which the cost of. Based on this information you divide the 40000 the original value of the vehicle by ten years the life of the vehicle to calculate the per year depreciation of this vehicle. Divide the total projected depreciation for the entire year by 12 to get the amount of monthly depreciation on the asset.

The depreciation calculator is quite useful in accounting. Section 179 deduction dollar limits. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The depreciation expense to complete the five year period would be calculated as 7 months. The depreciation calculator can also be used for calculating partial-year depreciation as well. Enter the rental income and expenses for the portion of the tax year the home was used as a rental property.

The straight line calculation steps are. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred. When you get to the depreciation section click Add to create a new asset. Subtract the estimated salvage value of the asset from.

Multiply the amount of the monthly. The calculator makes this calculation of course Asset Being. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

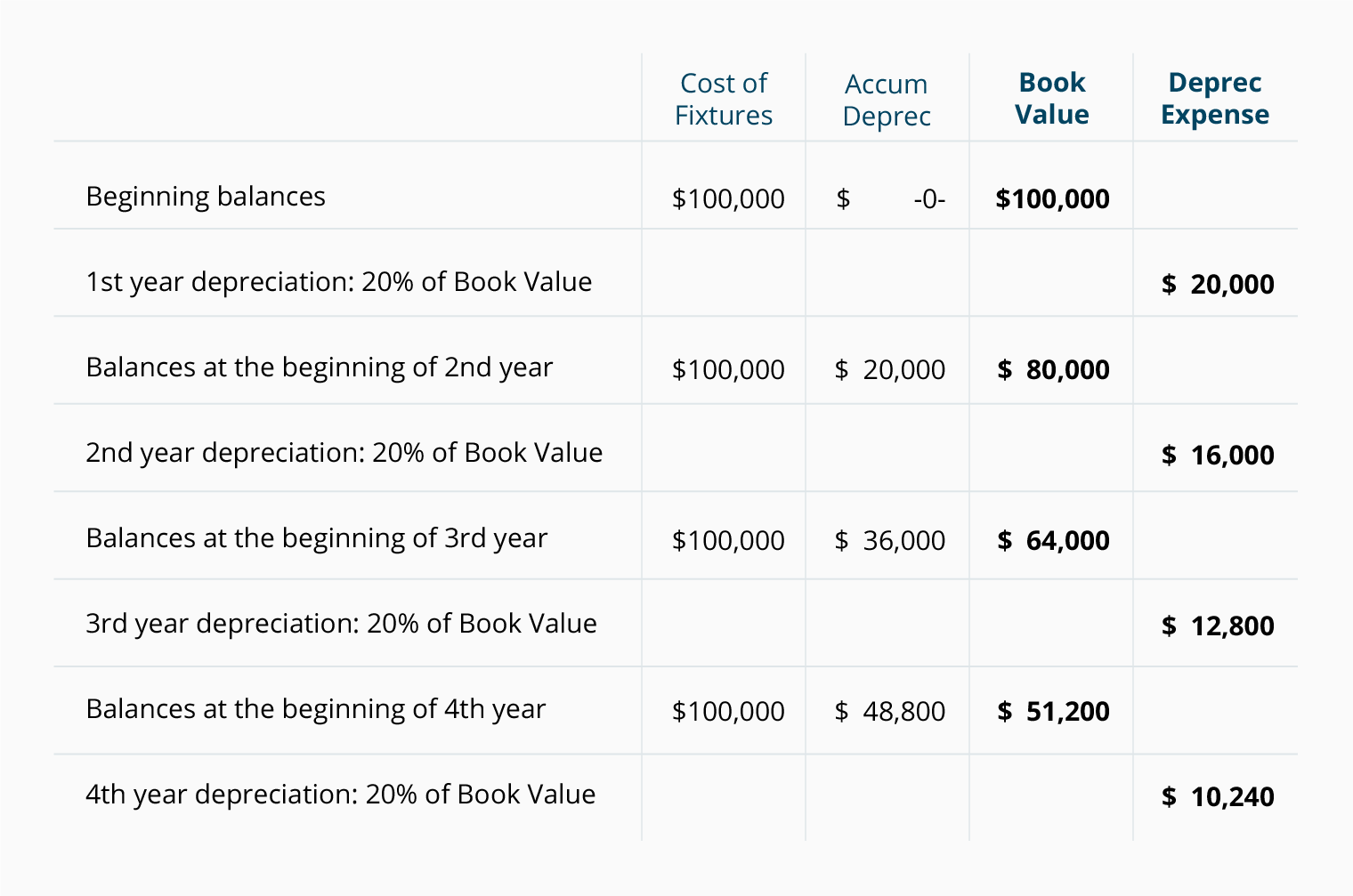

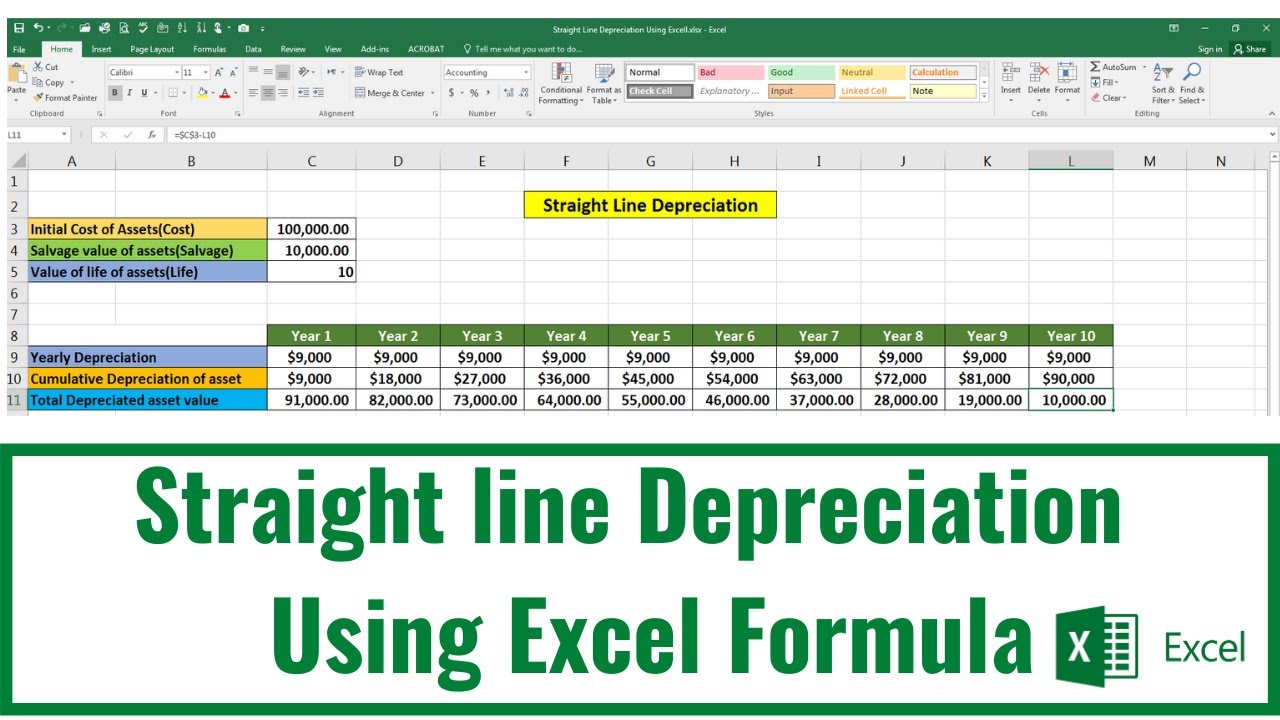

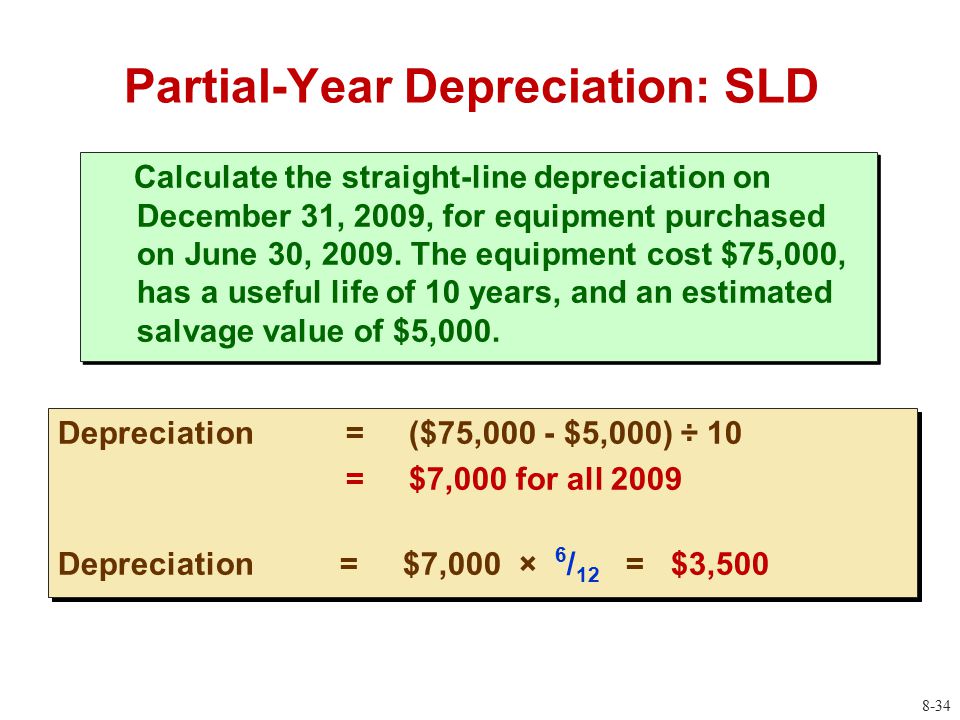

How to Calculate Straight Line Depreciation. Chart showing details for sample asset. Partial-Year Depreciation Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of 43000 on October 1.

Enter the rental income and expenses for the portion of the tax year the home was used as a rental property. Depreciation Method Asset Cost. It is designed to perform operations based on.

The first years depreciation would be 733 x 5 3665. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

2

Partial Year Double Declining Balance Depreciation Youtube

Partial Year Depreciation Financial Accounting Youtube

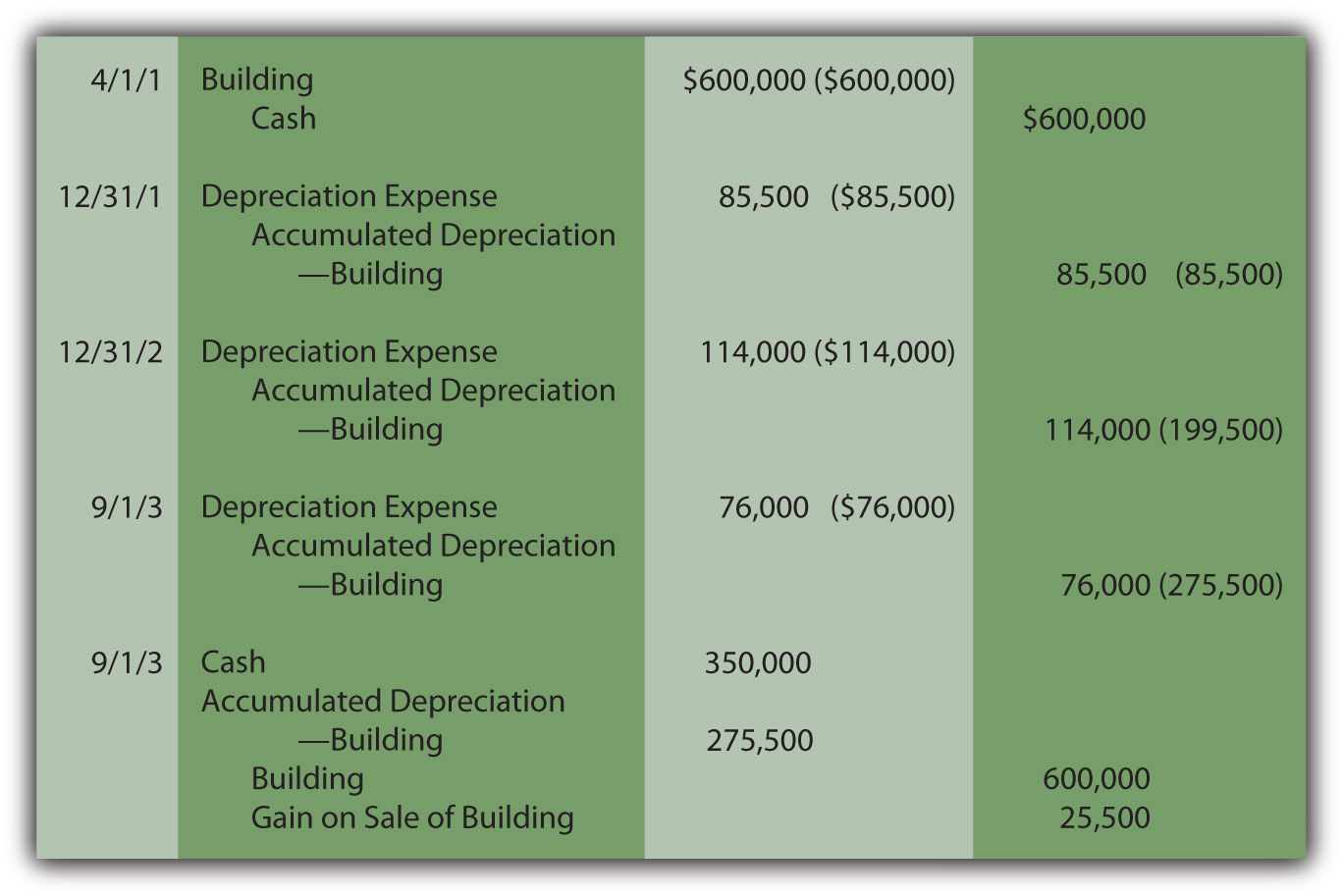

10 3 Recording Depreciation Expense For A Partial Year Financial Accounting

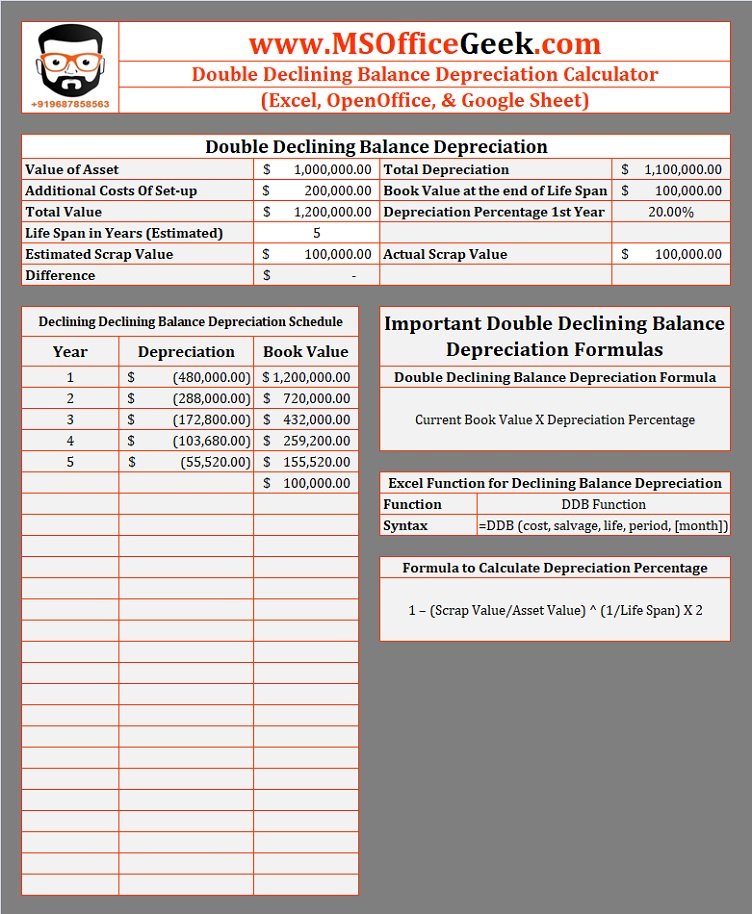

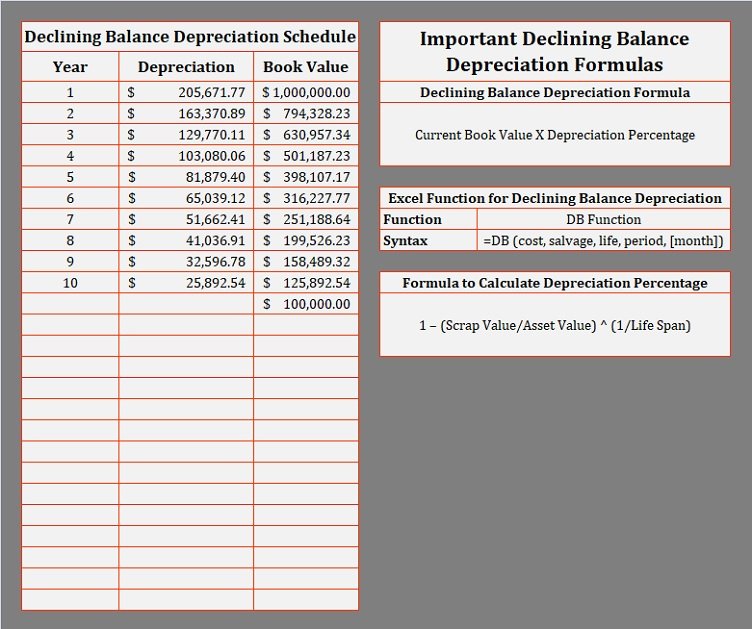

Declining Balance Depreciation Calculator Template Msofficegeek

Declining Balance Depreciation Calculator Template Msofficegeek

Long Term Assets Lecture 6 Partial Year Using Straight Line Depreciation Youtube

Depreciation Accounting Declining Balance Method With Partial Period Allocation Youtube

Declining Balance Depreciation Calculator Template Msofficegeek

6 7 Partial Year Depreciation Youtube

Declining Balance Depreciation Calculator

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Chapter 8 Long Term Assets Ppt Download

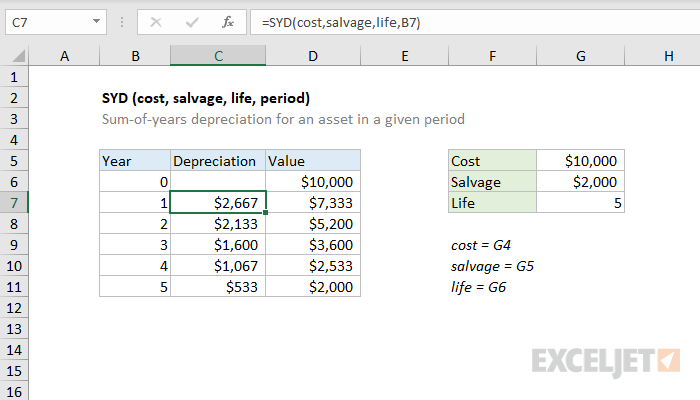

How To Use The Excel Syd Function Exceljet

Practical Of Straight Line Depreciation In Excel 2020 Youtube

Chapter 8 Long Term Assets Ppt Download

Declining Balance Depreciation Calculator Template Msofficegeek